Client Money Protection (CMP)

What is Client Money Protection (CMP)?

If you were to book a holiday, you wouldn’t hand over thousands of pounds to a travel agent without knowing your money was safe. The same goes for a property agent.

Although landlords will be familiar with the term CMP, it’s even more important to understand how it protects your interests now that the law has changed. From 1 April 2019, all property agents will need to sign-up to a government-approved CMP scheme – or risk a £30,000 fine.

But what does CMP mean for landlords, and why is it so important?

How does CMP work?

It’s estimated that agents hold £2.7 billion of clients’ money. CMP is a reimbursement scheme designed to safeguard this money, which pays tenants and landlords back should an agent misappropriate the rent, deposit or other client funds. In simple terms, it means you’re protected should an agent unexpectedly go bust or disappear.

To be eligible for CMP, the new legislation says that property agents need to prove that they are handling clients’ money appropriately. This means that agents need to:

- hold this money in a separate bank account to their operating funds, and;

- have the appropriate indemnity insurance so client money can be reclaimed if any employees commit fraud.

What’s changing?

Before the new law was introduced, it was estimated that around 60-80% of agents had joined a CMP scheme voluntarily, including all Propertymark member agents. But this meant that not all agents offered clients the peace of mind that their money was safe.

Every year, landlords and tenants lose money when funds are badly handled. In one case from 2012, a rogue letting agent fled the UK with £47,000 of tenants’ deposits and landlords’ rent. A police investigation found that he had been putting tenant deposits and rent into his personal account. Eventually, the rogue agent was arrested and sentenced to jail. His victims never saw their money returned.

Propertymark worked closely with the Ministry of Housing, Communities and Local Government (MHCLG) and in March 2017, the Government finally announced that all agents would need to protect the client money they handle. Elsewhere in the UK, agents in Wales must have CMP as part of the Rent Smart Wales initiative and Scotland introduced CMP as a legal requirement in January 2018.

What does CMP cover?

Client money covered includes landlords’ repair funds, rents, service charges and arbitration fees. If a tenant pays a deposit, it must be protected in a government-authorised Tenancy Deposit Protection (TDP) scheme – so the money is safe during this period. Due to the existing TDP law, the new CMP legislation only needs to cover tenancy deposit money whilst it’s with the agent i.e. before or after it’s protected by a TDP scheme.

Agents who don’t handle client money, for example, when the rent is paid directly to the landlord, will still be able to trade without the need for CMP.

As a landlord, what do I need to do?

Although the new law will mean that it will be compulsory for agents handling client money to have CMP; rogue operators do still exist.

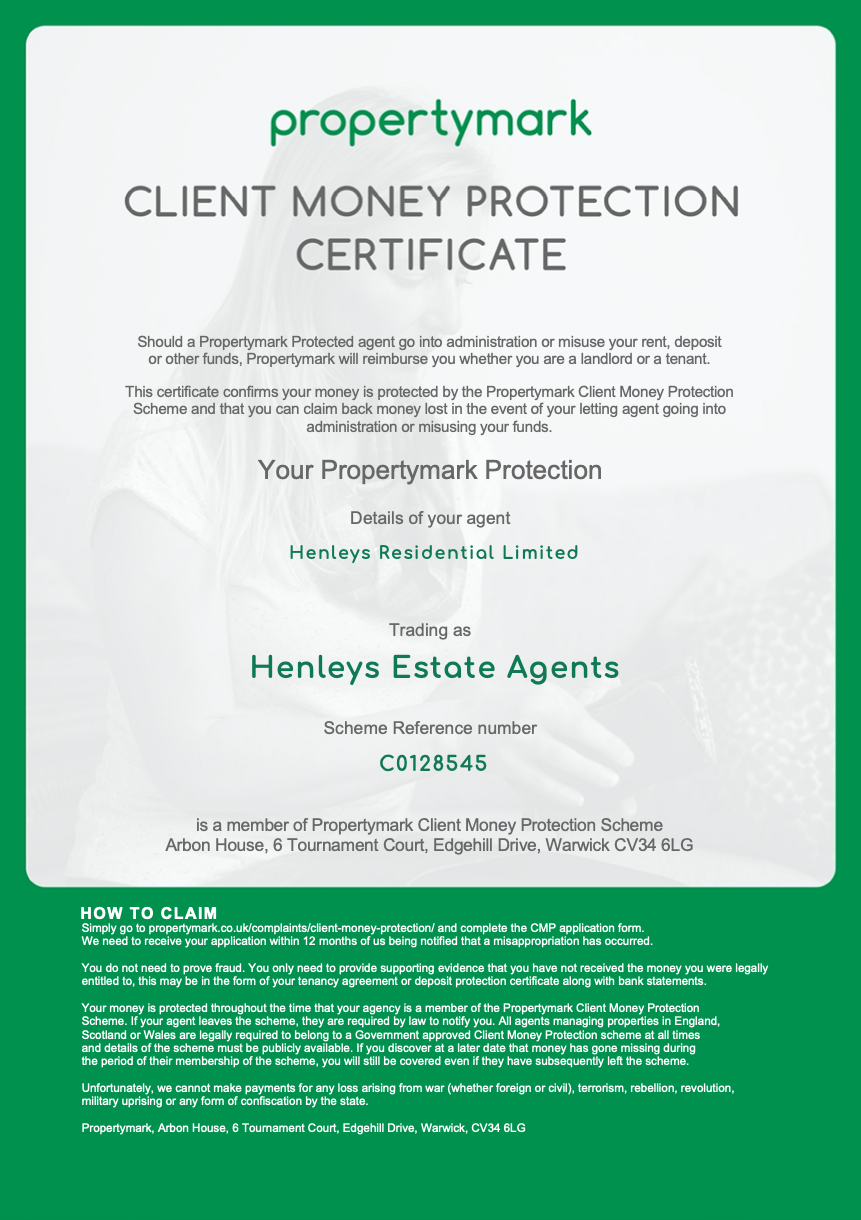

Before handing over any money or signing-up to an agreement with a property agent, make sure you see a copy of their CMP certificate and clarify which company provides the cover. You can find a list of the schemes authorised by the government here. Always be sure that your agent is complying with the law.

Who provides the schemes?

There are currently a number of companies authorised by the government to provide agents with CMP in England – including Propertymark.

Propertymark’s CMP cover will reimburse landlords and tenants who are out of pocket up to £15 million per year if their agent is within Propertymark’s Main Scheme, or £35 million per year if their agent is within Propertymark’s Large Corporate Scheme (with a maximum award of £50,000 per individual claim).

How do I make a claim?

The law is designed to be simple: if you can prove an agent has misappropriated your funds, you’ll be able to make a claim through the CMP scheme. You won’t need to go through the courts to get your money back.

Firstly, report the missing money to the police. Secondly, make a claim through Propertymark within 12 months. To do this, you’ll usually be asked to provide the following supporting documentation as evidence:

- The tenancy agreement

- Terms of business with the agent

- Bank statements illustrating a pattern of payments and then non-payment by the agent

- The tenant’s bank statements illustrating rental payments have been made.