Henleys News & Blog

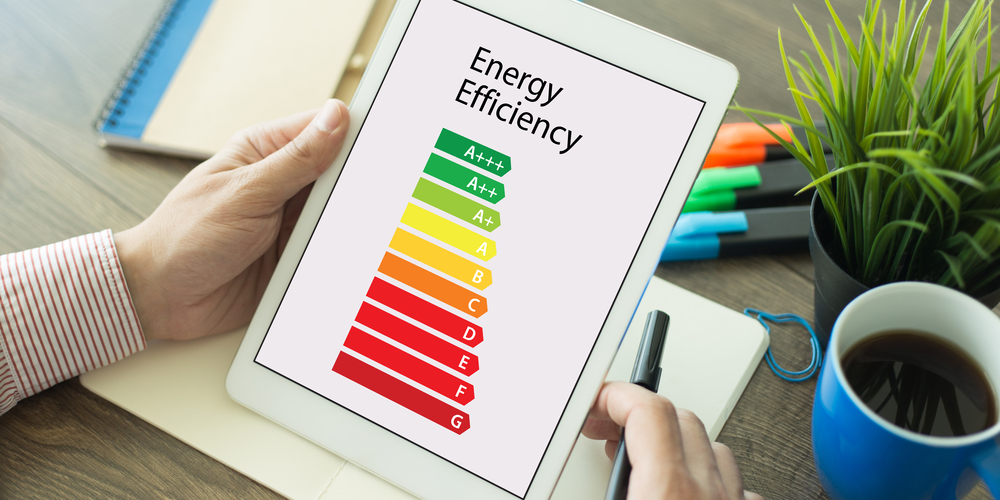

What is an EPC and how do I read it?

Energy Performance Certificates (EPCs) were introduced in 2007 to give buyers a better understanding of the energy efficiency of a property they may wish to buy. The EPC is a legal requirement if you are selling or renting a property and are valid for 10 years from date of issue.

Upgrade your bathroom and add value to your home

If you want to add value to your home, and make it a better place to live upgrading your bathroom can bring surprising benefits. One of the most important rooms in a house, it’s a place where you can relax and unwind after a hard day. As well as get ready before going out or calling it a night.

What will happen to the property market in 2020?

House prices increased by an average 33.7% in the last decade and despite being relatively flat over the last couple of years, due to the uncertainties surrounding Brexit, are set to rise by a further 15.3%, according to latest predictions, in the next 5 years. However, there are likely to be significant regional differences with properties in the North of England expected to see the strongest price growth of 24% between 2020 and 2024. Central London properties are also set for a rebound with predictions of 20% growth and only 5% growth in Greater London.

Buying and selling over Christmas

Think you need to avoid selling your property over Christmas? Think again. Potential buyers have more time over Christmas and, according to Rightmove, the Christmas period and particularly Boxing Day, is one of the busiest of the year, with people searching for a new home.

How to add £50k to the value of your house, in less than one week

According to the Federation of Master Builders (FMB) and the Home Owners Alliance (HOA), you can enhance the value of your property by almost £50,000 simply by removing an internal wall to create an open plan kitchen and dining area.

Private Residence Relief Changes

Did you know that when you rent out all or part of your home a Capital Gains Tax (CGT) charge may apply when you sell the property? Currently, HMRC exclude the last 18 months of your ownership – even if the property is let for this time – when assessing any CGT liability. However, in a draft of the Finance Bill released earlier this year, HMRC have confirmed that this 18-month period will be reduced to 9 months from April 2020. Disabled property owners, or those in a care home, will continue to be exempt for 36 months.

The house buying fees you’ll also need to budget for

If you’re thinking about buying a new home, you’ll need to budget for more than just the deposit. It’s a stressful time, saving! You work hard to put away savings each month and feel like celebrating when you have saved enough for that all important deposit. But don’t get carried away too early, as there are other costs that you need to take into account!

When you’re working out your ‘buying a house’ budget, you also need to take account of the cost of buying, your mortgage fees and moving costs – on top of your deposit. It all adds up and can easily plunge you into debt if an unexpected bill hasn’t been taken into account.

Latest Changes To Private Residence Relief

In July the Government confirmed its plans to change the way that Capital Gains Tax (CGT) is calculated for properties that are part or fully let.

10 Pitfalls To Avoid When Selling Your Property

Buying and selling a home can be a stressful process, so it’s important you are aware of the pitfalls that can cause a sale (or rental) to fall though. If you address these early in the process your chances of the deal going through is much greater.

According to the NAEA (National Association of Estate Agents) Propertymark, these are the factors that most commonly cause issues..

Landlord Rental Income Expenses

If you are a landlord or have a portfolio of properties, you can claim ‘wholly incurred’ expenses against your property income. Expenses must follow the standard HMRC guidance and the expenses must be exclusively for the purpose of renting out the property.

HMRC provide a number of examples of allowable expenses including:

If you buy a new vacuum cleaner for your own home, and also use it to clean your rental property between tenants, you can’t claim the cost of the vacuum cleaner as an expense against your rental income.

However, you could claim the cost of any cleaning products you bought specifically for cleaning the rental property.

Where costs are incurred partly for your rental business and partly for some other purpose you may be able to claim a proportion of that cost if that part can be separately identified as being incurred wholly and exclusively for the purposes of the property rental business.

Extending a home without having to submit a planning application

Want to extend your home, or a property that you are planning to buy? Here’s how to do it without having to submit a planning application.

Permitted development rights enable homeowners to make certain building works on a property without planning permission from the local council and without approval from a neighbour.